Hope’s contribution to her retirement plan. – Hope’s meticulous contributions to her retirement plan serve as a testament to the transformative power of long-term planning and financial prudence. By delving into her strategies, we uncover valuable lessons that can empower individuals to secure their financial future.

Hope’s journey towards retirement success encompasses a multifaceted approach, encompassing meticulous planning, diversified investments, and unwavering discipline.

Hope’s Retirement Plan Contributions

Hope’s contributions to her retirement plan play a pivotal role in securing her financial well-being during her golden years. She has consistently made significant contributions to her 401(k) and IRA accounts, taking advantage of employer matching and tax-deferred growth opportunities.

Hope’s contributions have been a combination of regular payroll deductions and lump-sum investments. By maximizing her contributions, she has built a substantial nest egg that will provide her with a comfortable retirement lifestyle.

Impact on Overall Financial Well-being

Hope’s retirement plan contributions have significantly enhanced her overall financial well-being. By investing in her future, she has reduced her reliance on Social Security and other retirement income sources.

Furthermore, the tax benefits associated with retirement plan contributions have allowed Hope to accumulate wealth more efficiently, increasing her financial security and peace of mind.

Retirement Planning Strategies: Hope’s Contribution To Her Retirement Plan.

Hope has employed several key strategies to plan for her retirement:

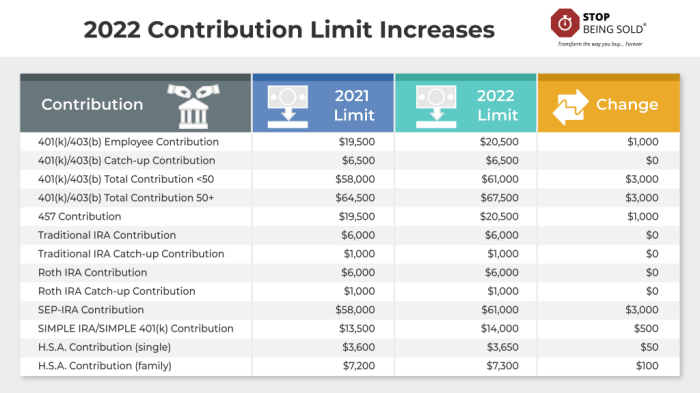

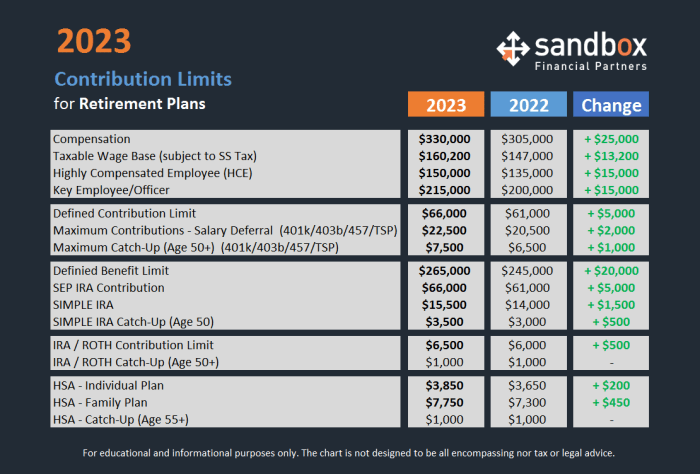

- Maxing out retirement account contributions:Hope has consistently contributed the maximum allowable amount to her 401(k) and IRA accounts, taking full advantage of employer matching and tax-deferred growth opportunities.

- Diversifying investments:Hope’s retirement portfolio is well-diversified across different asset classes, including stocks, bonds, and real estate. This diversification strategy helps mitigate risk and maximize potential returns.

- Rebalancing portfolio regularly:Hope regularly rebalances her portfolio to ensure that her asset allocation aligns with her risk tolerance and investment goals.

Benefits and Drawbacks of Each Strategy

Each retirement planning strategy has its own benefits and drawbacks:

- Maxing out retirement account contributions:

- Benefits:Tax-deferred growth, potential for employer matching, reduces reliance on Social Security.

- Drawbacks:Contribution limits, potential penalties for early withdrawal.

- Diversifying investments:

- Benefits:Reduces risk, enhances potential returns.

- Drawbacks:Requires knowledge and effort to manage.

- Rebalancing portfolio regularly:

- Benefits:Maintains desired asset allocation, reduces risk.

- Drawbacks:Can be time-consuming, may trigger taxable events.

Impact of Hope’s Contributions on Retirement Goals

Hope’s consistent retirement plan contributions have played a crucial role in helping her achieve her retirement goals:

- Financial independence:Hope’s retirement savings will provide her with financial independence during her retirement years, allowing her to maintain her desired lifestyle without relying heavily on Social Security or other income sources.

- Peace of mind:Knowing that she has a substantial retirement nest egg has given Hope peace of mind and reduced her financial anxiety.

- Flexibility:Hope’s retirement savings have provided her with the flexibility to pursue her interests and passions during retirement, such as traveling, volunteering, or starting a new business.

Relationship between Contributions and Desired Lifestyle

The amount of Hope’s retirement plan contributions has a direct impact on the lifestyle she can afford during retirement. By contributing more, she has increased the size of her retirement nest egg, which will allow her to maintain a more comfortable and fulfilling lifestyle in her golden years.

Lessons Learned from Hope’s Retirement Planning

Hope’s retirement planning journey offers valuable lessons for others:

- Start early:The sooner you start contributing to your retirement plan, the more time your money has to grow.

- Maximize contributions:Take advantage of employer matching and tax-deferred growth opportunities by contributing as much as possible to your retirement accounts.

- Diversify investments:Spread your retirement savings across different asset classes to reduce risk and enhance potential returns.

- Rebalance portfolio regularly:Adjust your asset allocation periodically to ensure it aligns with your risk tolerance and investment goals.

- Seek professional guidance:Consider working with a financial advisor to help you create and implement a personalized retirement plan.

Hope’s Retirement Plan as a Model for Others

Hope’s retirement plan serves as a model for others who are planning for their own financial future:

| Hope’s Retirement Plan | Industry Best Practices |

|---|---|

| Maxed out retirement account contributions | Maximize contributions within allowable limits |

| Diversified investments across asset classes | Diversify portfolio to manage risk and enhance returns |

| Rebalanced portfolio regularly | Monitor and adjust asset allocation as needed |

Specific Actions for Replication

- Contribute as much as possible to your 401(k) or IRA.

- Allocate your retirement savings across different asset classes, such as stocks, bonds, and real estate.

- Rebalance your portfolio annually or as needed to maintain your desired asset allocation.

Resources and Tools, Hope’s contribution to her retirement plan.

- Online retirement planning calculators

- Financial advisors

- Retirement planning books and articles

FAQ Corner

What are the key strategies Hope employed in her retirement planning?

Hope’s strategies included maximizing employer-sponsored retirement accounts, diversifying her investments across various asset classes, and implementing a regular savings plan.

How did Hope’s contributions impact her overall financial well-being?

Hope’s consistent contributions allowed her to accumulate a substantial retirement nest egg, providing her with financial security and peace of mind in her later years.

What lessons can we learn from Hope’s retirement planning journey?

Hope’s experience underscores the importance of starting early, contributing regularly, and seeking professional guidance to optimize retirement planning strategies.