The stark company adjusted trial balance stands as a cornerstone in the accounting process, providing a comprehensive snapshot of a company’s financial health. This guide delves into the intricacies of adjusted trial balances, exploring their significance, preparation, and role in financial statement creation.

By unraveling the complexities of this financial tool, we empower businesses to make informed decisions and gain a competitive edge.

Trial Balance Definition

A trial balance is a financial statement that lists all of the debit and credit account balances in the general ledger at a specific point in time. It is used to check the mathematical accuracy of the accounting records and to ensure that the total debits equal the total credits.

The trial balance is an important tool for accountants because it helps to identify any errors that may have been made in the recording of transactions. It can also be used to prepare financial statements, such as the income statement and balance sheet.

Purpose of a Trial Balance

The primary purpose of a trial balance is to check the mathematical accuracy of the accounting records. This is done by ensuring that the total debits equal the total credits. If the total debits do not equal the total credits, then there is an error in the accounting records that needs to be corrected.

The trial balance can also be used to prepare financial statements. The income statement shows the revenues and expenses of a company over a period of time. The balance sheet shows the assets, liabilities, and equity of a company at a specific point in time.

Adjusted Trial Balance Overview

An adjusted trial balance is a financial statement that presents the balances of all ledger accounts after adjustments have been made. It is a key step in the accounting process, as it helps to ensure that the financial statements are accurate and reliable.

An adjusted trial balance differs from an unadjusted trial balance in that it includes the effects of adjustments. Adjustments are made to correct for errors that have been made in the recording of transactions, to record transactions that have not yet been recorded, and to reflect the effects of events that have occurred since the last financial statements were prepared.

Adjustments are an important part of the accounting process because they help to ensure that the financial statements are accurate and reliable. By making adjustments, accountants can correct for errors, record transactions that have not yet been recorded, and reflect the effects of events that have occurred since the last financial statements were prepared.

Purpose of Adjustments

The purpose of adjustments is to ensure that the financial statements are accurate and reliable. By making adjustments, accountants can correct for errors, record transactions that have not yet been recorded, and reflect the effects of events that have occurred since the last financial statements were prepared.

Importance of Adjustments

Adjustments are important because they help to ensure that the financial statements are accurate and reliable. Accurate and reliable financial statements are essential for making informed decisions about a company’s financial health.

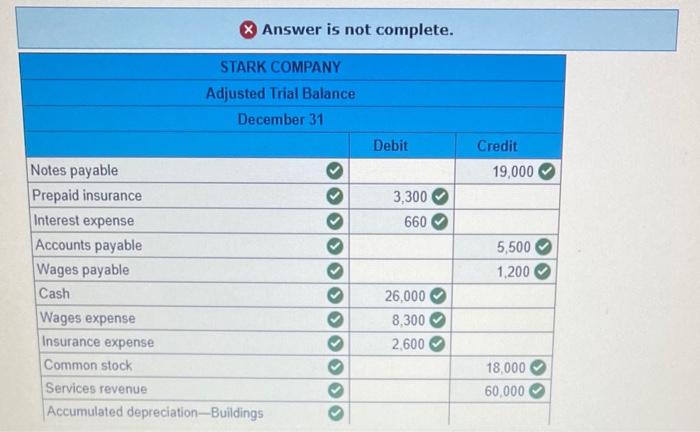

Preparing an Adjusted Trial Balance

An adjusted trial balance is a financial statement that lists all of a company’s accounts and their balances after adjustments have been made. Adjustments are made to correct errors and omissions in the original trial balance and to reflect the accrual basis of accounting.

The following are the steps involved in preparing an adjusted trial balance:

- Review the original trial balance for any errors or omissions.

- Make any necessary adjustments to the accounts.

- Prepare an adjusted trial balance by listing all of the accounts and their balances after adjustments have been made.

Common Adjustments

Some of the most common adjustments that are made to accounts include:

- Accrued expenses: Expenses that have been incurred but not yet paid.

- Deferred revenues: Revenues that have been received but not yet earned.

- Depreciation: The allocation of the cost of a fixed asset over its useful life.

- Amortization: The allocation of the cost of an intangible asset over its useful life.

Incorporating Adjustments into the Trial Balance

To incorporate adjustments into the trial balance, simply add or subtract the amount of the adjustment from the balance of the affected account. For example, if an accrued expense of $100 is discovered, the balance of the accrued expense account would be increased by $100.

Financial Statement Preparation

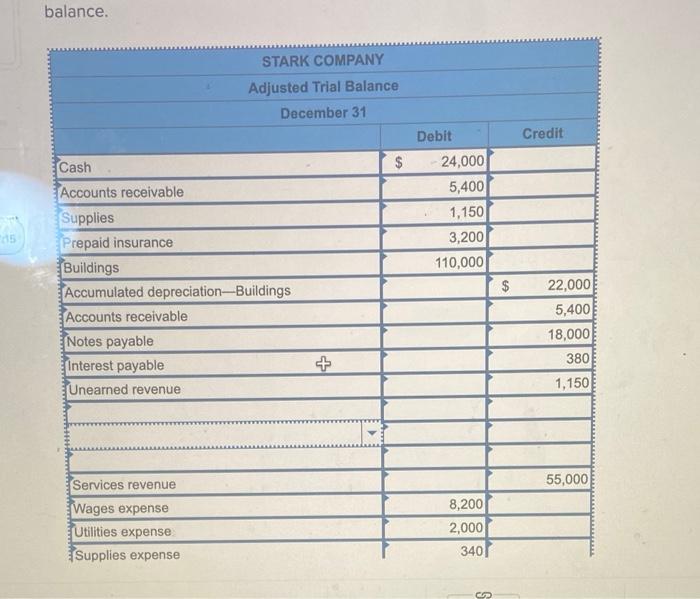

The adjusted trial balance plays a crucial role in the preparation of financial statements. It serves as a bridge between the trial balance and the financial statements, providing the necessary information to create the income statement, balance sheet, and statement of cash flows.

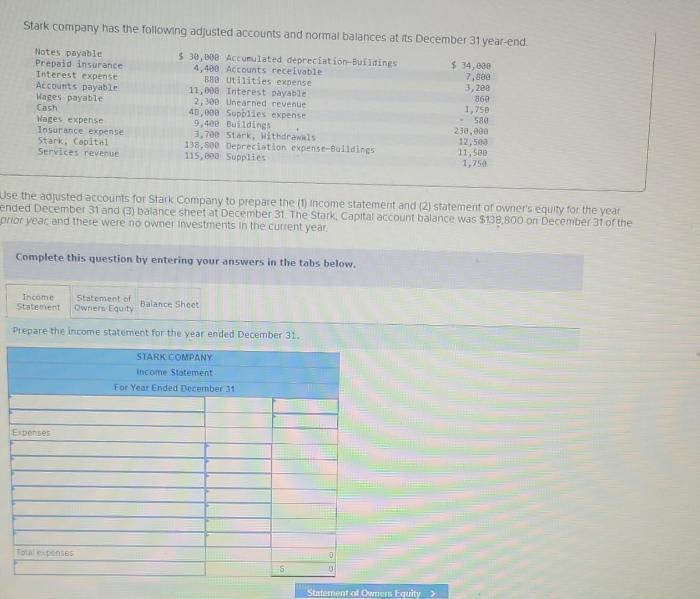

Income Statement

The adjusted trial balance is used to create the income statement, which reports the revenues, expenses, and profits of a company over a specific period. The revenues and expenses are derived from the revenue and expense accounts in the adjusted trial balance, while the profit is calculated by subtracting expenses from revenues.

Balance Sheet, Stark company adjusted trial balance

The adjusted trial balance is also used to create the balance sheet, which provides a snapshot of a company’s financial position at a specific point in time. The assets, liabilities, and equity are derived from the asset, liability, and equity accounts in the adjusted trial balance.

Statement of Cash Flows

The adjusted trial balance is used to create the statement of cash flows, which reports the cash inflows and outflows of a company over a specific period. The cash inflows and outflows are derived from the cash accounts in the adjusted trial balance.

Analysis of the Adjusted Trial Balance

The adjusted trial balance serves as a valuable tool for analyzing a company’s financial health and performance. It provides a comprehensive snapshot of the company’s financial position at a specific point in time and enables the calculation of key ratios and metrics that offer insights into the company’s liquidity, solvency, profitability, and efficiency.

By comparing the adjusted trial balance to prior periods or industry benchmarks, analysts and stakeholders can assess trends, identify areas for improvement, and make informed decisions about the company’s future.

Key Ratios and Metrics

- Current Ratio:Measures a company’s short-term liquidity and ability to meet its current obligations. Calculated as Current Assets / Current Liabilities.

- Quick Ratio (Acid-Test Ratio):A more conservative measure of liquidity, excluding inventory from current assets. Calculated as (Cash + Cash Equivalents + Accounts Receivable) / Current Liabilities.

- Debt-to-Equity Ratio:Assesses a company’s financial leverage and the proportion of debt used to finance its assets. Calculated as Total Debt / Total Equity.

- Gross Profit Margin:Indicates the percentage of revenue retained after deducting the cost of goods sold. Calculated as Gross Profit / Revenue.

- Net Profit Margin:Measures the profitability of a company’s operations, calculated as Net Income / Revenue.

Limitations and Pitfalls

While the adjusted trial balance provides valuable insights, it is essential to recognize its limitations:

- Limited Historical Perspective:The adjusted trial balance reflects a single point in time and does not provide a historical context or future projections.

- Exclusion of Non-Financial Information:The adjusted trial balance focuses on financial data and does not capture non-financial factors that may influence a company’s performance.

- Potential for Errors and Omissions:The accuracy of the adjusted trial balance depends on the accuracy of the underlying accounting records.

- Industry-Specific Factors:Key ratios and metrics may vary significantly across industries, and comparisons should be made within a relevant context.

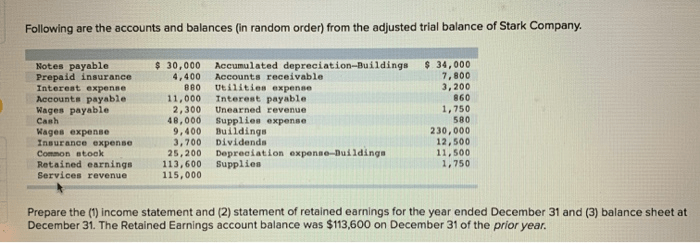

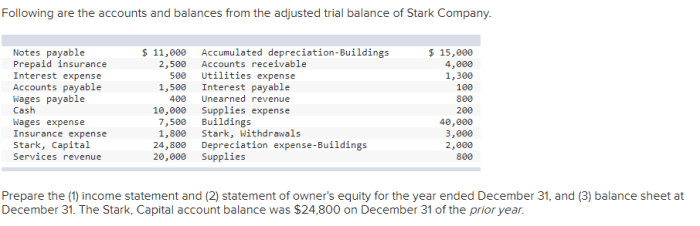

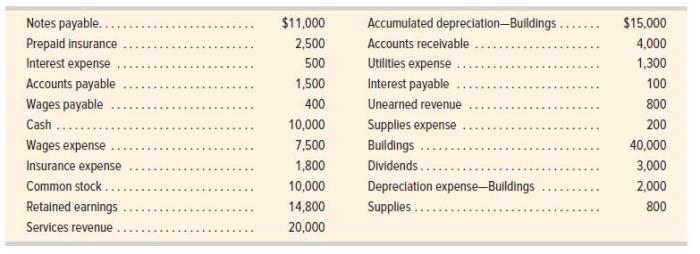

Real-World Examples: Stark Company Adjusted Trial Balance

Adjusted trial balances are indispensable tools used by businesses to ensure the accuracy and completeness of their financial records. They play a vital role in the preparation of financial statements and provide insights into a company’s financial performance.

Case Studies

- Example 1:XYZ Company, a multinational manufacturing corporation, uses adjusted trial balances to monitor its global operations. By regularly reviewing these balances, XYZ can identify discrepancies in its financial data and take corrective actions promptly, preventing potential losses and ensuring compliance with accounting standards.

- Example 2:ABC Retail Group, a leading retailer, relies on adjusted trial balances to prepare its quarterly financial statements. The company uses these balances to assess its sales performance, inventory levels, and overall profitability. This information helps ABC make informed decisions regarding pricing, inventory management, and marketing strategies.

- Example 3:DEF Construction Company, a major infrastructure developer, utilizes adjusted trial balances to track its project costs and revenues. The company’s financial team uses these balances to monitor project progress, identify potential cost overruns, and ensure that projects are completed within budget and on schedule.

Helpful Answers

What is the purpose of an adjusted trial balance?

An adjusted trial balance incorporates adjustments to account balances, ensuring their accuracy and completeness. It provides a more accurate representation of a company’s financial position and performance.

How does an adjusted trial balance differ from an unadjusted trial balance?

An unadjusted trial balance lists account balances before adjustments, while an adjusted trial balance reflects account balances after adjustments have been incorporated. Adjustments include accruals, deferrals, and other transactions that impact financial performance but may not have been recorded initially.

What are the key steps involved in preparing an adjusted trial balance?

Preparing an adjusted trial balance involves identifying necessary adjustments, recording them in the general journal, and updating account balances accordingly. Common adjustments include depreciation, prepaid expenses, and accrued revenues.